Looming Uncertainty

Poor policies are currently hurting solar power sector in India. In 2018 so far, there has been a dramatic decline in new capacity additions, and the trend is likely to continue because of increasing volatility in tender issuance, auctions, and capacity addition – -according to varied industry reports..

India, currently the world’s third-largest energy consumer after the US and China – still uses coal for over 55% of its energy mix. As part of its global climate change commitments, the country is running one of the world’s largest clean energy programmes with an aim of having 175 GW of clean energy capacity by 2022.

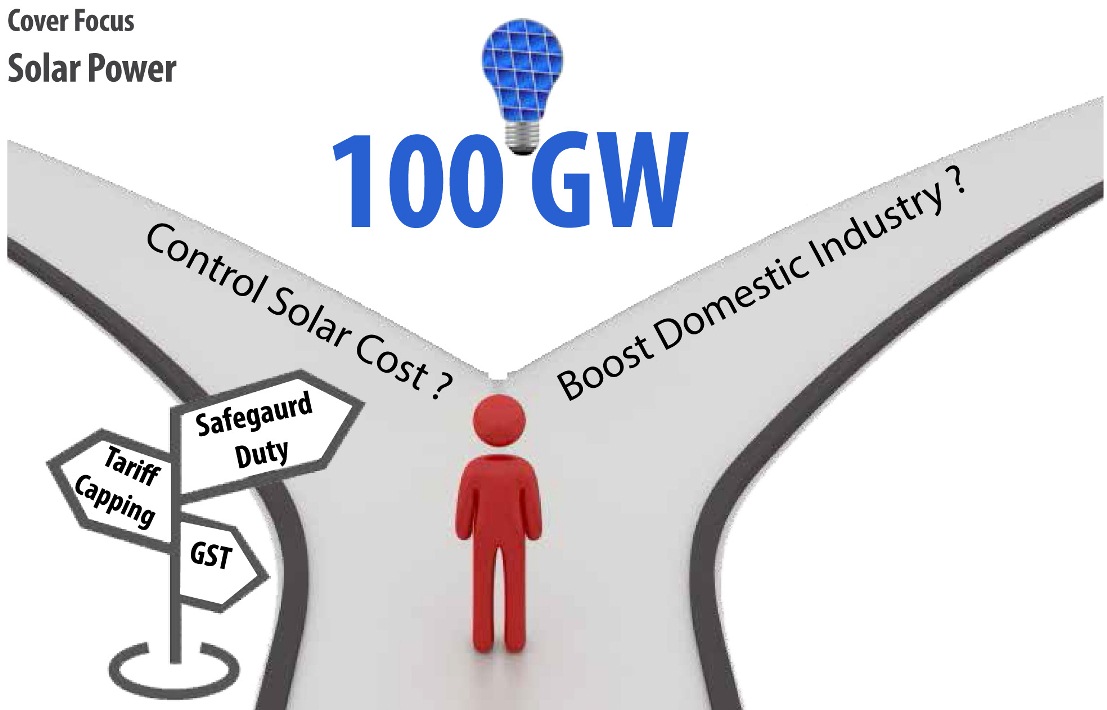

The solar power sector that is chasing a target of 100 GW of this 175 GW by 2022 is set to carry much of the pressure of India’s renewables push in coming years. It is essential therefore to know, what drives this industry as well as what challenges needs to be overcome before the huge potential of solar power in the nation can be attained.

Sector Overview:

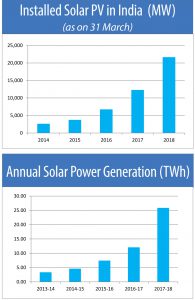

No doubt that the solar power industry in India has seen a fast track development since the NDA Government has come into power in 2014. As of 31 March 2018, with 24.5 GW of installed solar capacity – the nation has been able to expanded its solar power 9 times up from 2650 MW on 26 May 2014.

Earlier, the UPA government targeted 20 GW of solar capacity by 2022. In 2015, however, the NDA government raised its target to 100 GW solar power additions by 2022, and backed the industry with proactive strategies and measures that helped reach the 20 GW target four years ahead of schedule. The country added 3 GW of solar capacity in 2015-2016, 5 GW in 2016-2017 and over 10 GW in 2017-2018 and currently stands at 26GW of installed solar capacity as of Sep 2018..

Currently, Karnataka, Andhra Pradesh, Tamil Nadu, Rajasthan, Gujarat, Maharashtra and Madhya Pradesh are the leading states with majority of solar installations in the country. At the end of the 2017-18 fiscal year, Karnataka is India’s top solar state with an installed solar power capacity of over 5 000 MW.

Meanwhile, not everything is rosy on the ground in India’s solar power segment. A few of recent policy decisions have generated clouds of uncertainty over the country’s solar power sector, causing a sharp decline in new solar capacity additions in 2018.

According to consultancy firm Bridge to India (BTI), solar power capacity addition is slowing down in India. In the first six months of the present fiscal year (April-September 2018-19), the consulting firm revealed that the nation added only 1,900 MW of solar capacity that records a 44% decline as compared to the added solar capacity in the same span last year.

The consultancy BTI stated that including estimated utility scale capacity addition in the next two quarters, total installation in financial year 2018-19 is expected at only 4,100 MW, down a very significant 55 per cent over previous year and well short of MNRE’s 16,000 MW annual plan.

Looming Uncertainty:

India has seen a big revolution in solar energy push in recent years. However, prevailing policy uncertainty related to safeguard duties, a lack of long-term buyers and inefficient cost structures are all holding back Government’s ambitious plan while having adverse effect on investor sentiments.

Safeguard Duties: Under pressure from local manufacturers, the government levied safeguard duty on solar cells imported from China and Malaysia for two years on July 30. A duty of 25% has been imposed for imports in the first year starting July 30, and 20% and 15% for two subsequent six-month periods, respectively, as per the department of revenue’s notification. The imposition of safeguard duty has delayed financial closure for solar projects. Currently, investment of INR 15,000 to INR 20,000 crore is facing an uncertain future after the government levied safeguard duty on imports.

In addition, the developers are not getting a certainty for a pass-through from the state governments, making it difficult for them to approach banks for project financing. As a result we are seeing an unenthusiastic participation from developers in solar tenders. Already, 1,750 megawatts of solar bids out of 6,750 megawatts issued in 2017-18 have been scrapped so far according to media reports.

Though, the Ministry of Power in August asked the power regulator to allow pass-through of higher costs due to any change in levies. However, the central regulator is yet to ask state regulators to allow the pass through. Without states issuing directions to increase tariff, developers are facing a time-consuming and complex regulatory process to pass on additional costs under change in law in power purchase agreement.

Currency Depreciation: On the other hand, when India imports over 90 per cent of the modules, the currency depreciation has made imported solar modules costlier and has increased the cost of setting up solar power projects. Modules account for 55-60 per cent of the total cost of setting up a solar project, which is typically INR 5 crore per Mw.

According to analyst for every 10 per cent drop in the Rupee, the cost of setting up a solar power plant increases by INR 30 lakh per Mw, assuming other factors remain unchanged. Thus, the continuous fall in the value of the Rupee, nearly half of the solar power generation capacity worth INR 28,000 crore currently under implementation in India is facing viability risk.

Tariff Ceiling: According to media reports, the Ministry of New and Renewable Energy, has asked the Solar Energy Corporation of India to cap the tariff at INR 2.5 and INR 2.68 a unit for developers using locally made and imported solar panels, respectively. The higher cap was to factor in the impact of safeguard duty.

The ministry reportedly arrived at the limits after the recent 2,000-megawatt NTPC Ltd. got bids for Rs 2.59-2.60 a unit. A ceiling of Rs 2.68 a unit is unviable. Keeping in view factors like rupee depreciation, interest rates going up and safeguard duty, the impact on tariff is around 35-40 paise a unit. A tariff below Rs 2.95 a unit is unviable for a developer – echoed by industry stakeholders.

Way Forward:

Industry experts and analysts feel that the new duty and weak currency will have its toll on tariffs. As a result, a developer has to increase power tariff to set off the increase in cost, but utilities are not willing to buy power at a higher tariff. Moreover, the minister of power stated that even at lowest rates states don’t buy solar power. Union Power Minister RK Singh has warned that the country’s installed renewable energy capacity might get stranded as states are not very keen on purchasing solar power even at the lowest rate of Rs 2.44 per unit.

The minister also pointed out that SECI cannot afford to be in such a situation where it has to shell out Rs 40 lakh per year for every MW of renewable capacity without PPAs over 25 years. About 4 GW of recent solar bids, including 1 GW by Uttar Pradesh and 500 megawatts by Gujarat, have been scrapped due to high prices. The imposition of a 25% tariff on imports of solar cells / modules has worsen the situation, since this has added to the price increase.

Analysts have warned that the goal of adding 100 GW from solar power by 2022 could go for a toss if necessary steps are not taken in time to correct the way things are going.