Cables & Conductors – Market Overview & Outlook

Growing emphasis on developing a robust T&D network in the country to meet the rising demand for reliable power, a number of government initiatives and programmes have been undertaken that have helped create a positive market for cables and conductors in the country……..

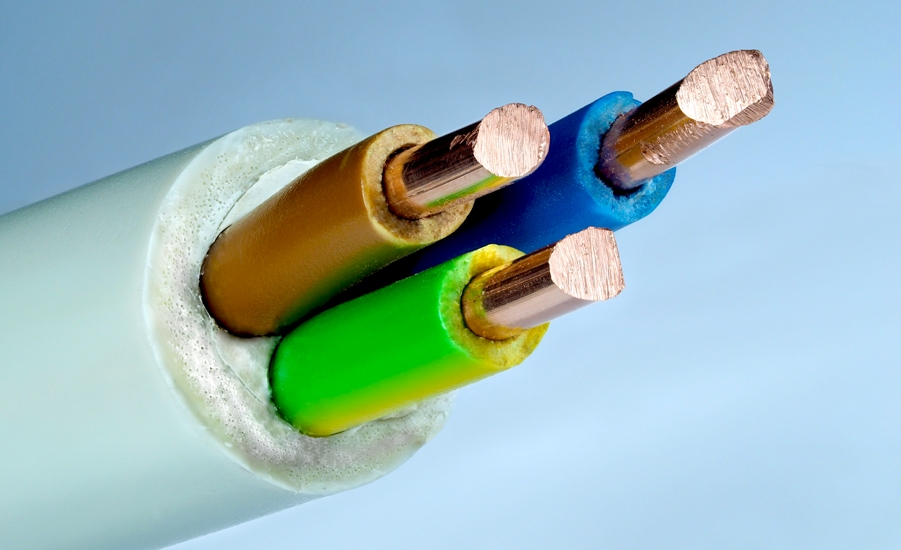

Cables & Conductors are one of the essential components required for the development and strengthening of any country’s T&D network. The cables and conductors market in India has grown at a significant rate in the past few years on the back of investments in the power and infrastructure sectors. The current manufacturing base is well established with a large number of organized players.

As of today, due to growing emphasis on developing a robust T&D network in the country to meet the rising demand for reliable power, a number of government initiatives and programmes have been undertaken that have helped create a positive market for cables and conductors in the country. As per various estimates, it is expected that the industry which has been growing at the rate of around 15 percent currently will start growing at the CAGR of over 20 percent over the next five years.

Market Overview:

Over the past two decades, Indian wires and cables industry has grown considerably in size while transforming itself into an organized one from being an unorganized sector. Though the unorganized sector still constitutes a notable one-third of the industry, however, the market is dominated by few major players. To be precise, the market is led by major players specializing in designing, manufacturing viz. Polycab wires, Finolex cables, CMI, RR Kabel, Sterlite Technologies, KEI Industries and Havells India. Other significant players include Cable Corporation of India, Cords Cable Industries, Diamond Power Infrastructure, Gupta Power Infrastructure Ltd., KEC International Ltd., LS Cable India, Shilpi Cable Technologies, Universal Cables, V-Guard Industries, etc.

The overall size of the cables industry in India is estimated to be around INR 412.50 billion in 2016-17 as per IEEMA, recording a moderate growth of around 5.1 percent over the previous FY 2015-16. As for the current financial year, the industry has registered a growth of 9.6 percent during the first half of FY 2017-18 (April to September). On the other hand, due to the delays in order finalizations by major buyers – the conductors market saw a decline of 10.76 percent falling in overall size from INR 81.25 billion in 2015-16 to INR 72.50 billion in 2016-17. Unfortunately, the segment is still facing the heat and negative growth of 17.40 percent during the first half of current FY 2017-18 (April to September). During 2016-17, the exports stood at INR 19.55 billion (registering a growth of 14.5 percent) and the imports stood at INR 5.76 billion (with a decline of 1.1 percent). Thus, the exports have supported the growth in the cable segment.

If we look at the exports/imports comparison during the first half of the current FY 2017-18, the total value of cable exports stood at INR 11.96 billion, whereas the cable imports during the same period stood at INR 4.59 billion. While the exports recorded an increase of 2 percent over the corresponding period in the previous year, the imports witnessed a sharp decline of 50 percent over the corresponding period of the previous year. On the other hand, during the first half of the current financial year 2017-18, the import of conductors stood at Rs 3.11 billion, recording a significant decline of 41 percent over the same period in the previous year. Fortunately, the exports of conductors registered a growth of 5 percent in this period and stood at Rs 8.29 billion.

Trends: Market & Technology

Overall, the cables and conductors industry has grown significantly in the past few years with investments infused in the power and infrastructure sectors by the government. While the cable segment witnessed a positive growth, the conductor segment experienced sluggish demand last year. Across cable sub-categories, the power cables segment registered a growth of 5.2 percent in 2016-17, while the control cables segment saw a decline of 3.4 percent. However, the first half of 2017-18 saw a reversal of trends wherein the high voltage power cable growth tumbled by 7 percent and the control cable segment grew by 2.9 percent.

The cable segment is the shift towards high voltage transmission lines. This demand is essentially driven by the creation of high capacity long distance corridors to deliver electricity to high demand regions and the development of green energy corridors for integrating the increasing share of renewable energy into the grid. Further, underground cabling is gaining increased acceptance among state and central transmission utilities as it provides greater safety (against electrocution) as compared to overhead cables.

On the technology front, the industry is witnessing a number of new technology being introduced to enable utilities to augment their capacities without encountering the issues of right-of-way (RoW) clearances. Further, due to the risks associated with bare overhead cables, covered cables have been gaining importance in the market. Cross-linked polyethylene (XLPE), high-density polyethylene, aerial bunched cables and spacer cable systems are some of the most commonly used covered cables.

In addition, an emerging technology trend of high-temperature low sag (HTLS) conductors is witnessing a greater adoption by the utilities. These conductors not only enhanced the operational efficiency but can also be used for the purpose of reconductoring the existing lines that enable utilities to transmit a higher quantum of power through existing corridors and can significantly scale down losses as well as instances of power outages. Further, to increase the current carrying capacity and scale down the transmission losses, utilities are turning to high-temperature superconductors (HTS) that have 5 to 10 times the current carrying capacity as compared to conventional conductors.

Gas-insulated lines (GILs) that can be installed under the ground as well as in tunnels and trenches are today a well-accepted technology trend in the overseas market. Due resistive losses of GILs being lower than overhead lines and other types of underground cables, they offer greater reliability with no risk of fire. This technology can serve as a viable alternative to overhead lines where RoW is not available for the transmission of electricity. However, it is still waiting to see a widespread adoption in the domestic market.

Opportunities Ahead:

Overall, the cables and conductors industry is open to significant growth opportunities on account of investments planned in the power and infrastructure sectors by the government. The large-scale grid integration of intermittent renewable energy and the centre’s focus on achieving “Power for All” by 2018 that is backed by initiatives and programmes support investment in network strengthening and up gradation are some of the positive growth indicators for cables and conductors industry. As per the Central Electricity Authority’s draft National Electricity Plan – Transmission, 2016, an investment of Rs 2,600 billion is expected to be made during the period 2017-18 to 2021-22 for transmission system augmentation in the country. Of this, Power Grid Corporation of India Limited (Powergrid) is expected to invest around Rs 1,000 billion.

Further, investment by the central government through schemes such as DDUGJY, IPDS, and Saubhagya will continue to maintain the demand in the cables and conductors segment. In addition, most of the states discoms are expected to improve their T&D infrastructure through renewed capital expenditure that signed in for UDAY scheme.

With the development of large-scale renewable energy plants and solar parks, is the need for integration of the new renewable-based capacity into the existing grid. Powergrid and the state transcos are also expected to undertake significant investments under the GEC project for improving connectivity to renewable energy projects.

Certainly, this can be counted as one of the major demand drivers for the cables and conductors industry. Another key driver for the growth is governments Smart Cities Mission which is expected to propel the demand in the country and present new opportunities in the cables and conductors segment.

Issues & Challenges

One of the biggest challenges faced by the industry is volatility in raw material prices. Any upward movements in the prices of raw material like steel, zinc, copper, and aluminium have an adverse effect on the profit margins.

In addition, as the wire and cable industry is dependent on imports from China, the UAE, Russia, and Japan, thus exchange rate variations highly affects the industry. Further, delay in the execution of projects due to the requirement of multiple clearances and approvals, and the shortage of manpower, this too poses a major impediment to the growth of the industry.

Lately, the industry is also seen grappling with the challenge pertaining to lack of fair level playing field in the market. In many of the instances, it is seen that the tenders released by utilities have specific pre-qualification condition that hampers the wider participation by the domestic industry. Also, being a large section of the industry still unorganized, there is lack of quality product offerings by these players, due to non- compliance with the product guidelines.

Way Forward

There is utmost need to look into corrective measures to deal with the issue faced by the industry. There is lack of standardisation of the end product posing a serious challenge for the sector. It is therefore imperative to develop standard guidelines for the industry as a whole so as the quality is not compromised. Further, the government should look into creating a single window clearance mechanism for all players to deal with the issue of delays in projects. This will help in faster project clearances leading to spur in the demands for the industry.

Though increasing industrialization and growing population requirement for reliable and efficient power supply have kept demand high for cables and conductors. Going forward, looking the investments infused in the power and infrastructure sectors by the government and various initiatives undertaken, this demand trend is expected to continue for the industry in the future as well.