U.D.A.Y…

A right step toward fixing the leaking bucket of DISCOM’s; but a lot needs to be done at ground level

For many decades, India’s electricity distribution sector has been in complete mess because of states turning blind eyes to the wrong doing of this sector. State DISCOM’s have been supplying electricity at tariffs that are far below cost. For obvious political reasons, States have been wary of revising power tariffs in line with rising costs. Inefficiencies in power distribution such as large transmission and distribution losses on power, have further strained the finances of the DISCOM’s, who have been borrowing heavily from banks to keep themselves running. As a result, the loss-making DISCOM’s piled up a massive load of debt on their books; it totalled INR 4.8 trillion in September 2015. According to the power ministry, distribution utilities lose INR 64,000 crore (INR 640 billion) every year.

The initial assessment of UDAY scheme suggests that both financial outcome and operational efficiency of reduction in AT&C losses have improved at an aggregate level. However, majority of discoms have failed to meet their operational efficiency targets…

With no finances in hand and drowning deep in debts – it becomes next to impossible to supply adequate power at affordable rates. Thus, the only practical way for DISCOM’s to stay operationally afloat was to aggressively use load management (power cuts) to control purchases. This means that vast parts of the world’s third-largest economic power go without electricity for more than half the day hampering the quality of life and overall economic growth and development.

UDAY Scheme

To improve the situation, a Scheme “UDAY” (Ujwal DISCOM Assurance Yojana) for financial turnaround of Power Distribution Companies has been formulated and launched by the Government on 20th November, 2015 in consultation with the various stakeholders for the financial and operational turnaround of DISCOMs and to ensure a sustainable permanent solution to the problem.

Under the scheme, States will take over three-fourths of the debt of their respective discoms. The governments will then issue ‘UDAY bonds’ to banks and other financial institutions to raise money to pay off the banks. The remaining 25 percent of the discom debt will be dealt within one of the two ways — conversion into lower interest rate loans by the lending banks or be funded by money raised through discom bonds backed by State guarantee. Backing from the State will help bring down the interest rate for the discoms.

In return for the bailout, the discoms have been given target dates (2017 to 2019) by which they will have to meet efficiency parameters such as reduction in power lost through transmission, theft and faulty metering, installing smart meters and implementing GIS (geographic information system) mapping of loss making areas. States will also have to ensure that power tariffs are revised regularly.

It is evident that the INR 10,000-crore (INR 100 billion) ‘Montek Bonds’ of 2002 and the INR 2-lakh-crore-plus Financial Restructuring Package for DISCOM’s of 2012 were not accompanied by proportionate changes in the efficiencies of the DISCOM’s. While, UDAY seeks to empower loss making DISCOM’s to break even in two-three years by helping the DISCOM’s in improving their operational efficiencies.

Performance Review

Since different states joined UDAY at a different point of time, with the majority (17 states) of them joining in FY17, the time elapsed by then until now is too short to assess the success of the scheme.

However, with DISCOMs actively feeding data on to the UDAY portal some positive outcomes have emerged and are encouraging. Participating States of UDAY have taken over the targeted debt of INR 2.09 trillion of their DISCOMs under borrowing exemption from the FRBM Act given in UDAY for the years 2015-16 and 2016-17.

Thus, the process of States taking over the targeted debts and issuing them as SDL Bonds has now been completed. As of now, the participating DISCOMs have to issue Bonds worth approximately INR 37,000 Crores, which would be done in due course. Rest of the debt with DISCOMs is mostly in the nature of CAPEX debt, which pays for itself, or Scheme based debt, which converts into grants fully or partially. Thus, they are not required to be taken over by the States.

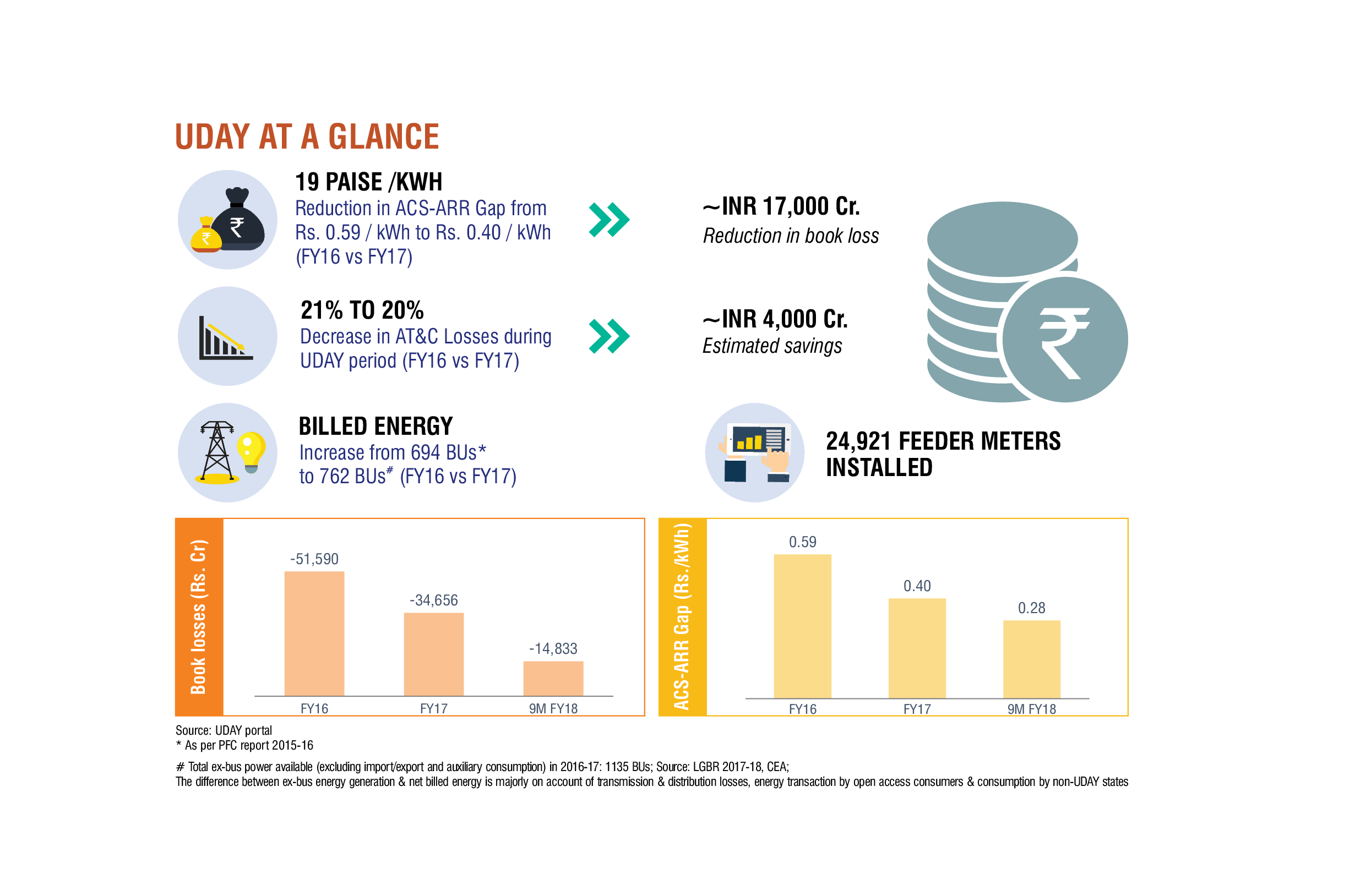

Further, as per the initial assessment of UDAY scheme suggests that both financial outcome and operational efficiency of reduction in AT&C losses have improved at an aggregate level.

AT&C loss: National average (all UDAY states) of AT&C loss has come down to 20.1% in FY17 from 21.1% in FY16. Total 11 states have reduced their AT&C loss from FY16 level. Under the initiatives of UDAY, continuous focus has been given on billing and collection efficiency of Discoms. At all India level, billing efficiency has increased by ~2% from 81% in FY16 to 83% in FY17.

Power purchase cost: Power purchase cost has reduced in 6 states. At overall level, the cost has reduced from Rs. 4.20 per unit in FY16 to about Rs. 4.16 per unit in FY17. These states have adopted various measures to optimize the input cost. Some of which are as following:

- Andhra Pradesh, Bihar, Haryana and Gujarat have significantly increased procurement of cheaper power from Power Exchanges (IEX and PXIL)

- Almost all the states have followed Merit Order Dispatch (MOD) methodology for power procurement and surrendered costlier power

- Cost of generation of few plants have reduced due to reduction in use of imported coal (few state gencos of above states and few NTPC plants)

- Few generating stations have reduced fuel transportation cost by using “All Rail Route” (e.g. Andhra Pradesh) and linkage rationalization (Haryana state plants, few NTPC plants)

Interest cost Benefits: One of the major elements incorporated to boost the financial turnaround of the distribution utilities under UDAY is the financial re-engineering of the debt of the distribution companies to eliminate the legacy burden. As stated, Governments of 16 States have taken over of around INR 2.09 lac cr debt of the distribution companies as per terms of UDAY MoU. Such loans were running at interest rates of around 11-12% p.a., which shall now be serviced by the States at rates ranging from 7%-8.5%.

Further a few DISCOMs have also restructured their balance loan portion at reduced rates, which will also reduce the interest burden by at around 3%-4%. The savings accrued to DISCOMs on account of interest benefits due to above, takeover & restructuring works out to INR 15000 crores approximately by March, 2017.

ACS-ARR Gap: The reduction in ACS-ARR Gap is the combined effect of savings in interest cost, power purchase cost, tariff rationalization, better billing/collection efficiency etc. and it is expected that these benefits shall continue and further improve in future and provide a sustainability to the distribution utilities. Gap between Average Cost of Supply (ACS) and Average Revenue Realized (ARR) has reduced in 12 states. At overall level, the gap has reduced from 59 paisa per unit in FY16 to about 46 paisa per unit in FY17.

While Gujarat DISCOMs are maintaining positive bottom-lines, Haryana, Chhattisgarh and Himachal Pradesh DISCOMs are on the threshold of turnaround. Rajasthan DISCOMs have reduced their book loss by ~70%. DISCOMs of Andhra Pradesh, Telangana, Tamilnadu, Maharashtra, and Assam have reduced their book losses. With increased focus on loss reduction and financial discipline, book losses are expected to come down further in coming years.

Twelve (12) Discoms have reduced subsidy dependence (subsidy booked/Total revenue) from last year. Till March 2017, major improvements have been noticed from APEPDCL (from 10% to 2%), DVVNL, UP (30% to 17%) and SBPDCL, Bihar (from 46% to 40%). In addition, marginal improvements (1-3%) have been noticed from Chhattisgarh, Rajasthan, Karnataka and other UP Discoms. With increased sales to industrial and non-domestic segments and moderate cross-subsidy, subsidy dependence of the states may reduce further.

Conclusion

Though, improvements are seen on the two crucial measures of performance of discoms – in reducing the gap between average cost of electricity supplied and the average revenue realisation and reduction in ‘aggregate technical and commercial’ (AT&C) losses. It helped reducing Discom losses by INR15,906 cr from FY16 to FY17.

However, most states have missed operational targets set for the end of FY17. Out of the 31 states who are participating in UDAY, only six states and one Union Territory had met their targets for FY17. Gujarat, Himachal Pradesh, Karnataka, Tripura, Uttarakhand, Goa and Puducherry were the only states able to meet their AT&C loss targets.

However, the long-term success of UDAY will come only from “structural changes aimed at bringing down AT&C losses and improvement in billing and collection efficiency. Without Discoms meeting their operational targets it would be hard for them to sustain the reduction of losses going forward.