PV Modules Market – India

More than 110 Indian solar cell and module makers are registered with the government, out of which only a handful are expected to survive as orders funnelled through a domestic-content policy have all but dried up, leaving some of India’s biggest solar panels manufacturers on the verge of facing financial collapse, priced out by Chinese competitors as they had been struggling to win contracts.

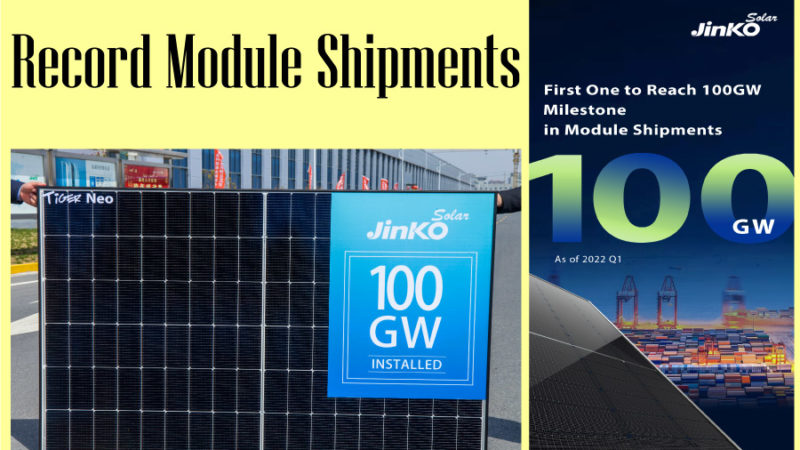

The solar power sector in India is on an exponential growth path. A capacity addition of 3,269 MW of solar has been reported in India during the first quarter of calendar year 2018. The cumulative installed solar capacity in India totalled 22.8 GW at the end of March 2018. The major beneficiary of this growth have been the Chinese companies, accounting for around 85 percent of India’s solar module demand and earning around $2 billion, according to industry data.

Going forward, India goes all-out to achieve the bold targets lay out under the National Solar Mission (NSM) which will need an annual run rate of 15-20 GW in solar installations to hit that goal of 100 GW by 2022. Based on current installed capacity there is almost 80 GW more to go that would translate into the total annual market opportunity of more than $10 billion over the next few years, going by the government’s capacity targets.

Industry & Market Overview:

The domestic manufacturing capacity for solar cells in India is estimated to be more than 3.5 GW and that for solar modules in excess of 10 GW. Indian companies produced an estimated 1.33 GW of modules last year out of the total capacity of 5.29 GW, according to Bridge to India. Total consumption of modules—60 percent of a solar project’s cost—was around 4 GW.

Some of the issues faced by domestic manufacturers include – lack of scale, absence of raw material supply chains and rapidly changing technology is making it difficult for Indian firms to compete with Chinese manufacturers. Further, as the government prioritises cheap solar power over local manufacturing, Indian solar power plant developers—including companies backed by Japan’s Softbank and Goldman Sachs—are quoting ever-lower tariffs in auctions to win big projects, encouraged by steep drop in Chinese solar equipment prices.

In addition, orders funnelled through a domestic-content policy have all but dried up after the World Trade Organization last September upheld an earlier ruling that found the move violated global trade norms. It is squeezing out Indian cell and module makers, leaving some of India’s biggest solar panels manufacturers on the verge of facing financial collapse, priced out by Chinese competitors as they had been struggling to win contracts.

As the data shows the import for solar sector is on rise, from around 70 percent imports from China last year had gone up to 80 per ent this year. Something has to be done as the domestic sector capacity is not being properly harnessed and more than 50-60 percent of the country’s installed capacity represents idle plants.

Today there are more than 110 Indian solar cell and module makers registered with the government, out of which only a handful are expected to survive, according to solar consultancy firm Bridge to India. This call for a serious attention from the central government which needs to take some concrete steps to accelerate the growth of the solar energy sector by resolving policy-related issues facing the domestic industry, in order to provide necessary boost, before it is too late.

Rising Imports:

India has seen a continuous rise in solar imports and China accounts for the largest portion of these imports. In the last quarter (Q4) of FY 2017-18, India imported solar modules and cells worth $1.083 billion registering a steep rise as compared to Q3 of FY 2017-18, where India imported solar modules and cells worth over $799 million.

On the other hand, there was a steep decline in solar exports from India as exported modules and cells worth approximately $19.15 million during the Q4 of FY 2017-18 as compared to India’s export of solar modules and cells worth $70.18 million in Q3 of FY18. This is 73 percent more than the $19.15 million worth of solar exports from India in Q1 2018.

As per the data available for the last quarter of FY18; the Chinese companies accounted for nearly 91.5 percent of all solar imports in the country. Industry analysts feels that major policy changes in China announced recently, imposing installation caps and reduction called for in the feed-in tariff could result in declining module prices and increased imports of Chinese panels into India. However it is interesting to note that not all the modules are imported by developers, a significant portion of the modules are being imported by Indian manufacturers who re-brand the modules for sale.

India is in the midst of its own trade investigations to consider safeguard and/or anti-dumping duty on cells and modules. We feel that the Indian government has a much tougher call as the downstream market is extremely price sensitive and any price shock would detract from the vastly ambitious target of 100 GW by 2022.

Domestic Industry Woes

Now a thorny question facing India is how to manage demand for solar panels and other components that are critical to the implementation of projects and growth of the sector. The country has two options, either to import the panels or make them domestically. However, due to introduction of extremely competitive reverse auctions in solar sector, India is currently a highly price-sensitive market. Since Chinese PV modules are ~ 15%-20% cheaper than Indian PV modules (notwithstanding any countervailing/dumping duties) charged on import of PV modules, the domestic solar manufacturing had been hit by this cheaper import in earlier years – thus adversely affecting the growth of domestic manufacturing.

Hence, the real long-term option for India is to develop a strong indigenous manufacturing base. Though to support the domestic solar industry, MNRE has initiated a Domestic Content Requirement (DCR) under the National Solar Mission so that a portion of projects offered for bidding was to be built through domestic content. Unfortunately, this was challenged by the American government at the World Trade Organization. Thus, increasing issues related to DCR has caused huge blow to Indian Solar PV module manufacturing. In addition, India’s fascination towards grid parity and low solar tariffs and inconsistent policies, has proved to be another huge disadvantage to India’s solar PV module manufacturing.

Recent Development

To support and promote the domestic solar manufacturing industry, the government has been working on several initiatives. Towards the end of 2017 the MNRE released draft schemes for encouraging domestic solar PV manufacturing in terms of earmarking certain projects for domestic content and a capital subsidy scheme (M-SIPS) for setting up of the solar manufacturing facility.

Regarding the incentives, Union Minister of State (Independent charge) of the ministry of power and new and renewable energy – R.K. Singh stated that the programme is being supported by the Government of India through a Special Incentive Package Scheme (SIPS)/ Modified Special Incentive Package Scheme (M-SIPS). The scheme, provides for 20-25% subsidy for investments in capital expenditure for setting up of the electronic manufacturing facility and reimbursement of Countervailing Duty (CVD)/ Excise Duty (wherever applicable) for capital equipment for the units outside Special Economic Zones (SEZ).

The incentives are available for several categories of electronic products and product components, including poly-silicon, ingots, solar photovoltaic (SPV), cells, modules/panels. Units across the value chain starting from raw materials to assembly, testing, and packaging of these product categories are included.

Way forward

The Indian government’s overriding priority in the sector, so far, has been increasing generation capacity and lowering tariffs. That focus has hurt the prospects of domestic manufacturers who are unable to compete with Chinese imports and have now filed a new anti-dumping duty petition. Though, it has been consistently argued that protectionism will not solve the problems of Indian manufacturers. But ever-increasing share of imports for solar modules is a concern when India plans to meet a significant share of its power requirement from solar and a huge majority of modules are imported from a single country. The entire sector is exposed to the risk of a potential disruption in global supply chain and/or change in international political, trade or economic environment.

For rapid deployment of a strong domestic manufacturing base the country needs continuity of demand so as to give investors confidence to back domestic manufacturing. Though government has taken some positive steps in this direction; as of December 2017, 23.65 GW had been tendered, out of which letters of intent for 19.34 GW have been issued. Around 35 solar parks totalling 20 GW have been approved in 21 states. The target under the country’s “Development of Solar Parks and Ultra-Mega Solar Power Projects” scheme has also been increased to 40 GW, from 20 GW.

Fortunately the existing units that have suffered but are now raring to go with new capacities include Tata Power Solar, Adani, Jupiter and Indo Solar, to name just a few. In addition, new investors that have committed large scale financing, such as SoftBank and GCL, are looking for policy clarity and risk mitigation through better demand calibration. Such weighty backers are likely to head to India with large-scale investments covering the entire value chain from Ingots and wafers to cells and modules, but they badly needed private capital to flow and for banks to show their eagerness to support.