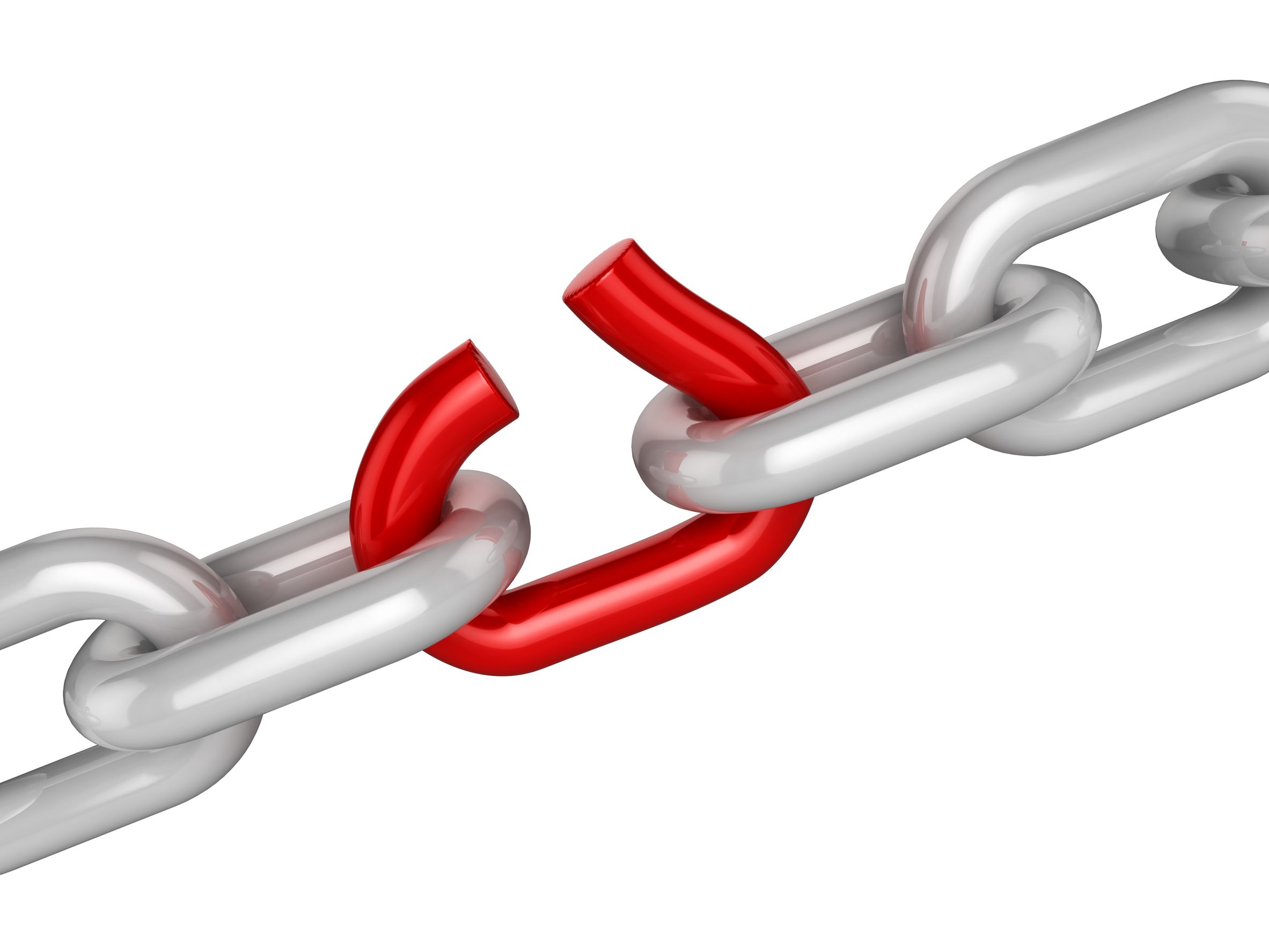

The Weakest Link

The distribution segment in India has remained as the weakest link in the Power sector value chain since decades, however the government of India has taken some proactive measures in recent years to save the Discoms trapped in a vicious cycle with operational losses and being funded by debt…

The power sector in India has witnessed admirable improvements over the last few years across the entire value chain, from fuel supply to generation, transmission and consumption. Still, the weakest link in the value chain is distribution, wherein Discoms (power distribution companies) in the country accumulated losses of about Rs 3.8 lakh crore and outstanding debt of about Rs 4.3 lakh crore in 2014-15, with interest rates upto 14-15%.

Distribution is the most important link in the entire power sector value chain and being only interface between utilities and consumers, it is the cash register for the entire sector. Under the Indian Constitution, power is a concurrent subject and the responsibility for distribution and supply of power to rural and urban consumers rests with the states. Due to legacy issues, the distribution segment has continued to wrestle with an array of challenges including untimely tariff revisions, high network losses, and poor billing and collection efficiency resulting in high accumulated losses.

Resultantly, distribution company’s (DISCOMs) have built up huge pile of debt ~Rs.4.3 lakh crore as on Mar-2015. Since, the poor financial health of DISCOMs impacted their power off take ability; it adversely affected the performance of the country’s generation segment resulting in increase in stressed assets in the sector. Thus, looking at the distressed situation of the country’s power distribution sector, the Government of India (GoI) in November 2015 launched Ujawal DISCOM Assurance Yojana (UDAY) with an objective of financial turnaround of DISCOMs and to improve their operational and financial efficiencies.

Sector Overview:

The Discoms sector in India has been witnessing poor financial and operational health since decades. Discoms suffer losses either due to technical reasons on account of below average quality of network infrastructure or commercial reasons on account of subsidised pricing, electricity theft, inefficient billing and collection. Losses due to technical reasons can be minimised by using latest technology and modern equipment for transmitting and distributing electricity.

At the commercial level, the losses incurred can be managed by resisting the pressure to provide electricity for free to certain groups; pricing the electricity by taking into account the input, production, transmission and distribution cost along with a healthy profit and not based on political expediency; and reducing the cases of electricity thefts by unscrupulous people or entities.

Prevailing Ailments:

The challenge before the union government has been to create a reliable and sustained power generation and distribution mechanism in the country such that adequate, affordable and consistent electricity supply can be made available to all the private citizens together with the key sectors of the economy – agriculture, manufacturing and services – which in turn would ensure a healthy and continued growth in all the three sectors.

Thus in order to assist distribution utilities in improving operational efficiency and to undertake network expansion and modernisation, the Government of India provides assistance to states through various Central Sector / centrally sponsored schemes such as IPDS and DDUGJY. However, the financially strained Discoms failed to supply adequate power at affordable rates, thus schemes which aim at 100% village electrification, 24X7 power supply and clean energy etc cannot be turned into reality without financially strengthening the Discoms first.

This realisation paved the way for the union cabinet, chaired by Prime Minister Narendra Modi, to give its approval to a new scheme in November 2015 — Ujwal Discom Assurance Yojna or UDAY – moved by the power ministry. UDAY was launched in November 2015 and the last date to join the scheme was March 31, 2017 – in order provides for the financial turnaround and revival of Discoms. Under the scheme, the states completed the takeover of their respective discoms’ debt in March 2017. Meanwhile, bonds worth Rs 2.32 trillion (addressing 86 per cent of the debt envisaged to be taken over under UDAY) have been issued. As of August 2017, bonds worth Rs 370 billion remain to be issued, which would be done in due course.

This realisation paved the way for the union cabinet, chaired by Prime Minister Narendra Modi, to give its approval to a new scheme in November 2015 — Ujwal Discom Assurance Yojna or UDAY – moved by the power ministry. UDAY was launched in November 2015 and the last date to join the scheme was March 31, 2017 – in order provides for the financial turnaround and revival of Discoms. Under the scheme, the states completed the takeover of their respective discoms’ debt in March 2017. Meanwhile, bonds worth Rs 2.32 trillion (addressing 86 per cent of the debt envisaged to be taken over under UDAY) have been issued. As of August 2017, bonds worth Rs 370 billion remain to be issued, which would be done in due course.

Performance Check

The good news is that a notable progress has been recorded resulting in overall improvement in the discoms operational performance. For one, the level of AT&C losses (for the 26 states and the union territory of Puducherry participating in UDAY) declined from 21 per cent in FY16 to 20 per cent in FY17 resulting in INR 17,000 crore reduction in book losses.

Further, the gap between the average cost of supply (ACS) and average revenue realised (ARR) reduced from Rs. 0.59 per unit in FY16 to Rs. 0.40 per unit in FY17 resulting in an estimated saving of INR 4000 crore and is continuing on its declining trend. In addition, there were around 24,921 feeder meters installed and an increase in billed energy from 694 BUs* in FY16 to 762 BUs in FY17 has been recorded during the period.

On September 25, 2017, the government has launched yet another scheme called the Pradhan Mantri Sahaj Bijli Har Ghar Yojana (Saubhagya) with the aim of electrifying all households by December 2018. However, there are several issues that still plagues the sector including inadequate tariff revisions in various states and low power demand from the discoms and need to be seriously tackled.

Way forward:

With power demand expected to surge in the coming years, power distribution reforms are likely to remain high on the government’s agenda as evident from the recently launched Saubhagya scheme. While the improvement in operational efficiency has been slower than targeted, it is still remarkable considering the dismal performance of the distribution segment in the past.

Going ahead, the MoP is preparing a long-term distribution perspective plan. Under this, the Central Electricity Authority will determine the infrastructure and investments required by the discoms on an annual basis till 2021-22. Other focus areas include open access, separation of carriage and content, rationalisation of tariffs, and reduction in subsidies.

Overall, the segment is likely to have a bright future provided that government initiatives are implemented in a timely and effective manner.